vfiax stock price morningstar

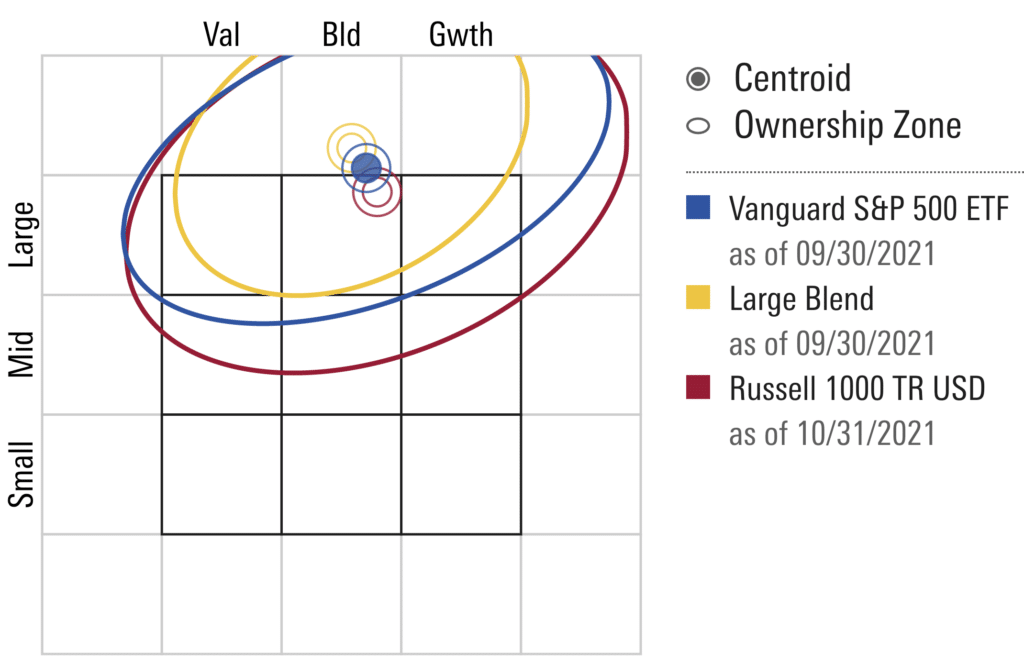

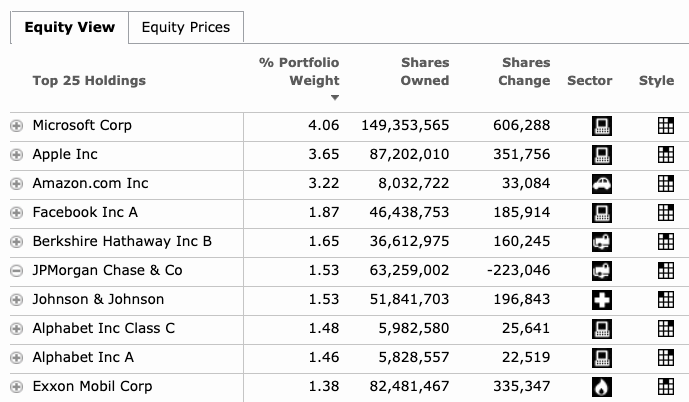

This fund is currently holding about 9765 stock in stocks and these companies have an average market capitalization of 27901 billion. The Vanguard 500 Index was incepted in August 1976 and is managed by the Vanguard Group.

Half Of The Nest Egg Is In At T Bogleheads Org

37201 871 240.

. Looking at the 1 year perf data the comparison result is opposiste. Market indices are shown in real time except for the DJIA which is. See Vanguard 500 Index Fund VFIAX mutual fund ratings from all the top fund analysts in one place.

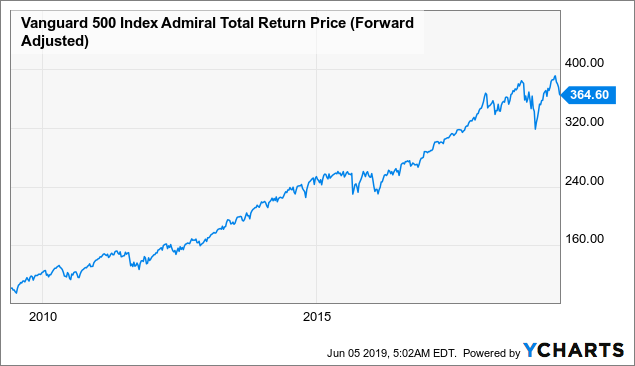

The actual dividend yield is currently. The fund employs a passive management strategy designed to track the performance of the SP 500 Index. Monday through Friday 8 am.

Vanguards advisor site tells us that the SEC yield of VOO is 123 while that of VFIAX is 122. Morningstar Return Rating NA1. VFIAX Vanguard 500 Index Fund Admira.

To 8 pm Eastern time. They both track the same 500 index. If youre already a Vanguard client.

The fund employs an indexing investment approach designed to track the performance of the Standard Poors 500 Index a widely recognized benchmark of US. Vanguard 500 Index offers diversified low-turnover exposure to US. Vfiax stock price morningstar Friday February 25 2022 Edit.

Large-cap stocks at an attractive price. Although the return is very close. Stock market performance that is dominated by the stocks of large US.

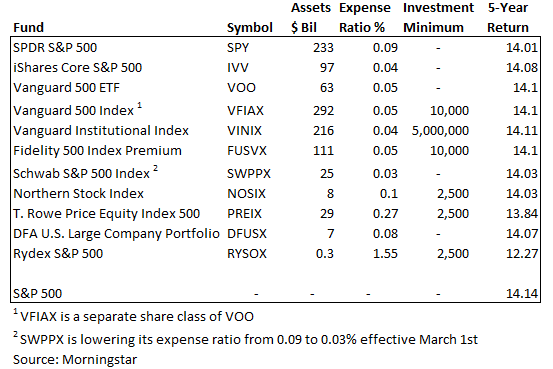

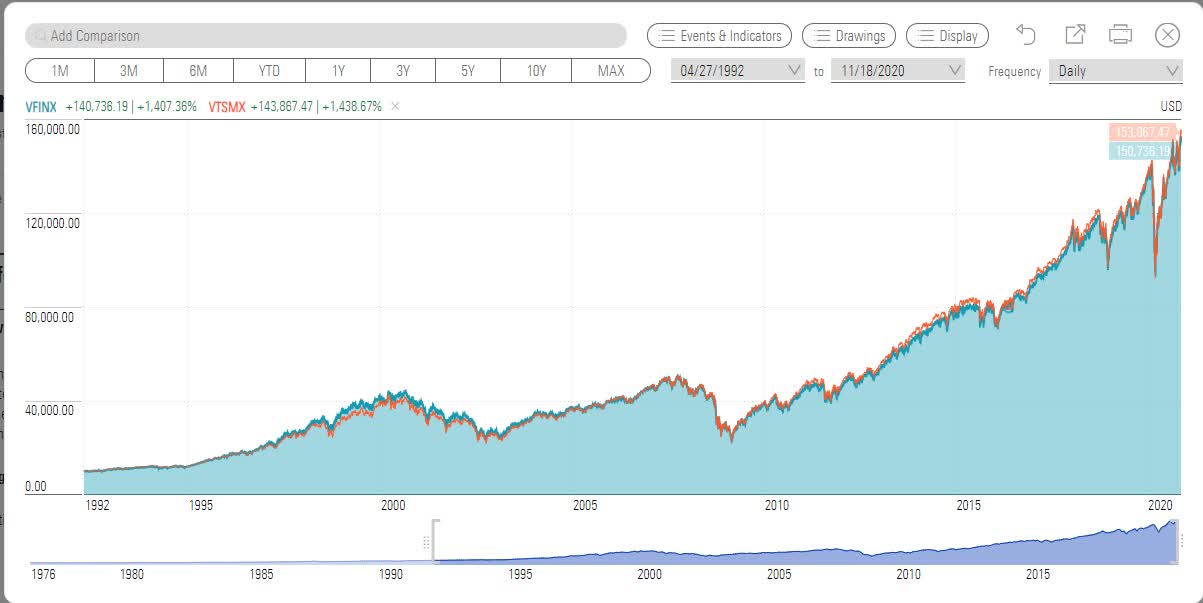

VFIAX has a higher 5-year return than VOO 1362 vs 1343. VFIAX has a higher expense ratio than VOO 004 vs 003. Find the latest Vanguard 500 Index Fund VFIAX stock quote history news and other vital information to help you with your stock trading and investing.

XNAS quote with Morningstars data and independent analysis. VFIAX A complete Vanguard 500 Index FundAdmiral mutual fund overview by MarketWatch. The expense of VFIAX is 004 and FXAIX is 0015.

Visitors trend 2W 10W 9M. Most stock quote data provided by BATS. Compare and contrast.

VFIAX 1-yr return 1774 and FXAIX is 1755. View mutual fund news mutual fund market and mutual fund interest rates. Of the 248 stock funds.

VFIAX vs VOO. VFIAX is a mutual fund whereas VOO is an ETF. It tracks the market-cap-weighted SP 500 which has historically been tough.

Vanguard 500 Index Fund VFIAX Nasdaq - Nasdaq Delayed Price. See Vanguard 500 Index Fund performance holdings fees risk. FD1001 Customer 2 years ago.

Stay up to date with the current NAV star rating asset allocation capital gains. Find the latest Vanguard Value Index Adm VVIAX. The advisor attempts to replicate the target index by investing all or substantially all.

Stock price you can quickly find it out by visiting Finny and typing VFIAX quoteIf youre looking for a quick scoop on VFIAX stock price chart key stats buy or sell analysis and holdings go to Finny and look for VFIAXYoull get all this info in one place. So in theory FXAIX should have better performance than VFIAX. The Fund seeks to track the performance of its benchmark index the SP 500.

Voo Vs Vti An Easy Way To Choose Between An S P 500 And Total Stock Market Index Fund Robberger Com

My 33 Investment Years Morningstar

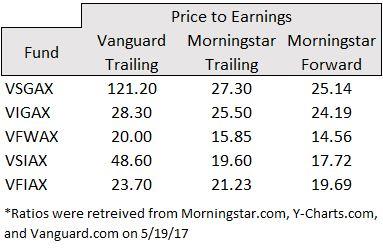

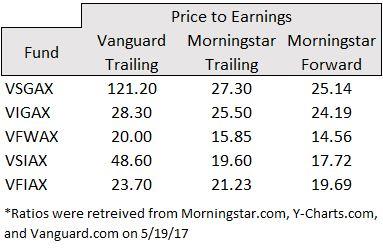

Your Mutual Fund S P E Is Likely Very Wrong Seeking Alpha

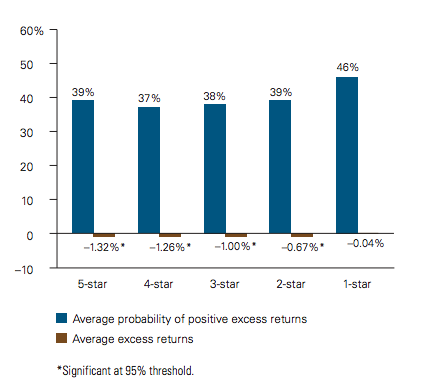

The Best Core Stock Funds Morningstar

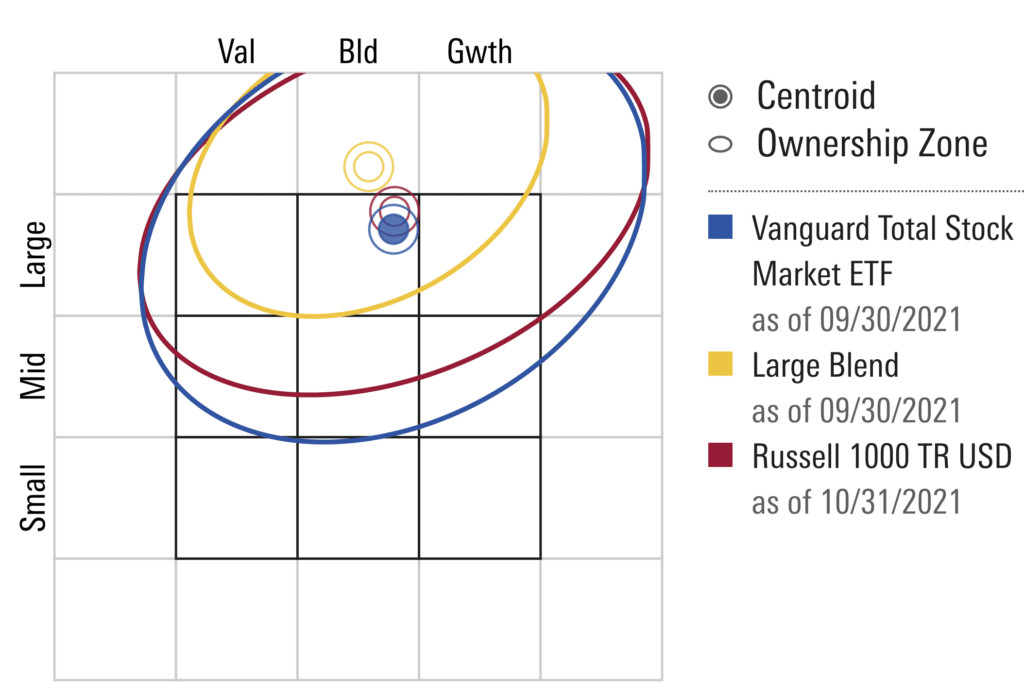

Voo Vs Vti An Easy Way To Choose Between An S P 500 And Total Stock Market Index Fund Robberger Com

How To Argue For S P Bogleheads Org

Voo Vs Vti Smackdown Know How They Differ Before You Invest Nysearca Voo Seeking Alpha

Vfiax A Long Term Core Etf To Hold That Tracks S P 500 Index Efficiently Vfiax Seeking Alpha

Vtiax Vtsax Why Low Morningstar Ranking Bogleheads Org

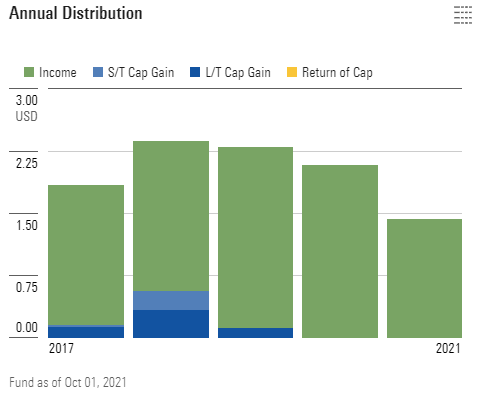

Did Dividend Stock Funds Provide Downside Protection In 2020 Bogleheads Org

Sp500 Vs Index Fund Bogleheads Org

Vtsax Vs Vfiax What Am I Missing Bogleheads Org

Voo Vs Vfiax Which Is Better For Long Term Investors Vfiax Seeking Alpha

Morningstar User Guide Overview Video 1 Youtube

Vfiax A Long Term Core Etf To Hold That Tracks S P 500 Index Efficiently Vfiax Seeking Alpha